Singapore is one of the most stable countries in the world, and highly pragmatic. Yet, it is also one of the most innovative – it is small enough to be nimble but big enough to matter, highlighted former DBS chief executive Piyush Gupta.

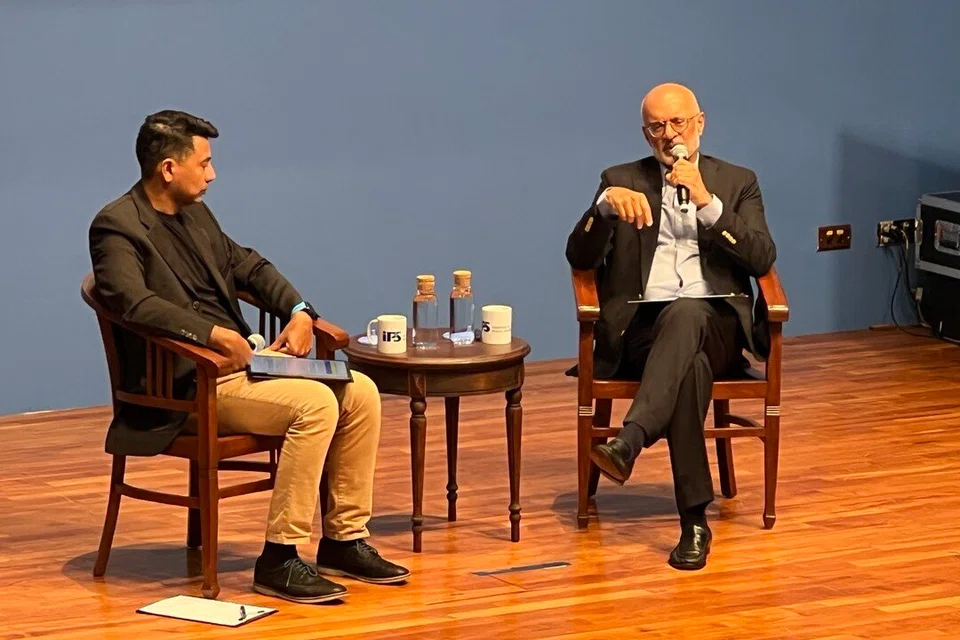

He was speaking at the third and final lecture of the 17th IPS-Nathan Lecture series titled “The Future of Finance: How Singapore Can Continue to Punch Above Its Weight” on Dec 8 at the National University of Singapore.

There is scope to be bolder in reimagining the future of payments, such as by launching a digital Singapore dollar, Mr Piyush pointed out.

“The launch of a digital Singapore dollar would further entrench Singapore’s reputation as a leading global financial centre at the forefront of future technologies. It would send a strong signal of our position as being ahead of the game and our national intent to embrace a new tokenised world,” he said.

Mr Piyush noted that DBS was one of the first banks globally to launch a digital exchange to enable trading in digital assets, but it was not allowed to expand access to retail customers.

Singapore has embarked on several blockchain and tokenisation pilots, but these remain at the experimental level, Mr Piyush noted.

“The Monetary Authority of Singapore has been conservative in certain areas, such as its approach to allowing retail access to cryptocurrencies.”

He said that Singapore is now in a position of strength, armed with an abundance of financial, technological, and human resources to help architect a new financial infrastructure and transform how finance flows.

“Smart contracts and tokenised forms of exchange, including new forms of currency, along with Gen AI and agentic AI, could pave the way for a more efficient, cost-effective, and innovative financial system,” he said.

He noted that beyond payment infrastructure, there are also opportunities to revolutionise Singapore’s capital markets, especially its equity markets.

Tokenisation offers the potential for greater efficiency and automation across the entire value chain, including issuance, trading, settlement, and asset servicing.

“There is thus potential for Singapore to be bolder in shoehorning industry players to adopt a new blockchain and token-based infrastructure to transform capital markets,” he added.

He noted that there are enough opportunities for Singapore to proceed without waiting for global alignment that will inevitably be long in coming.