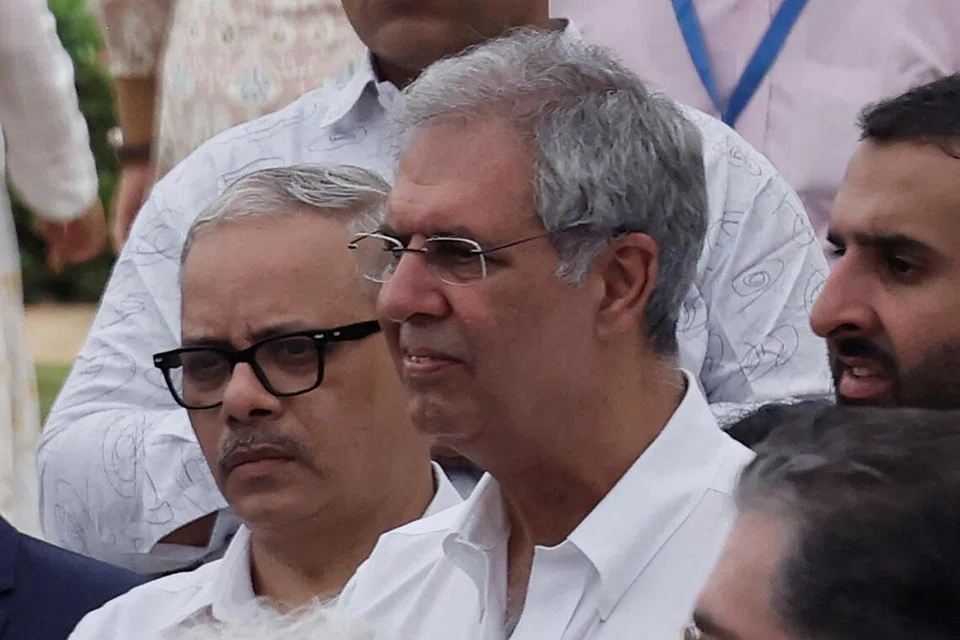

In a significant reshaping of the Tata Group’s leadership ecosystem, Mr Mehli Mistry – cousin of the late Cyrus Mistry and a long-time confidant of Mr Ratan Tata – has been voted out as trustee of Tata Trusts, marking a major consolidation of power under chairman Noel Tata.

Mr Mistry’s exit follows months of governance friction and internal divisions within the Trusts, which control 66 per cent of Tata Sons, the holding company of the US$180-billion (S$233 billion) Tata conglomerate, reported The Times of India.

The differences had even reached New Delhi, with key Tata executives meeting Home Minister Amit Shah and Finance Minister Nirmala Sitharaman recently. The ministers reportedly told them to ensure the differences were resolved amicably.

With interest from fast-moving consumer goods to automobiles, steel, software, and now even semiconductors, the Tata Group is very important to India’s economic prospects.

Mr Mistry’s removal effectively strengthens Mr Noel’s influence over both the group’s philanthropic and strategic decisions, restoring what insiders call “clarity and cohesion” to the Trusts’ leadership.

The decision came after a split among trustees, with Mr Noel, Mr Venu Srinivasan, and Mr Vijay Singh opposing Mr Mistry’s reappointment, while Mr Darius Khambata, Mr Jehangir Jehangir, and Mr Pramit Jhaveri voted in favour.

As Mr Mistry could not vote on a resolution involving himself, his three-year term ended on Oct 28.

The rift reportedly deepened in September when Mr Mistry’s faction blocked the reappointment of Mr Singh as a nominee director on the Tata Sons board, citing age-related review norms.

Mr Noel and Mr Srinivasan opposed the move, viewing it as disruptive. Mr Mistry had maintained his reappointment was a “procedural formality,” referencing a 2024 resolution allowing lifetime renewals for trustees – a stance others rejected as inconsistent with fiduciary obligations.

“Mistry’s interpretation reduced critical board decisions to formalities,” said one trustee. “Trust deeds require active oversight, not automatic extensions.”

His removal, sources say, allows the Trusts to “rebuild consensus” and refocus on long-term priorities. Legal experts, however, caution that Mr Mistry could still challenge the decision in court, potentially reigniting tensions reminiscent of the 2016 Tata-Mistry corporate feud that followed Mr Cyrus Mistry’s ouster as Tata Sons chairman.

Observers note that Mr Mistry’s exit cements Mr Noel’s leadership at a pivotal time. The group faces crucial decisions on Tata Sons’ potential IPO, governance reforms, and strategic investments, while also seeking Reserve Bank of India clearance to surrender its “core investment company” status to avoid mandatory listing.

“Noel Tata now commands a stable majority within the Trusts,” said corporate lawyer Swapnil Kothari. “That clarity is critical to bridge the current trust deficit and ensure smoother governance across the Tata ecosystem.

“ However, the fact that there are two camps with diverse views can itself result in a vociferous feud, which the Tatas as a globally renowned institution can ill-afford.”

Mr Kothari added that clarity in leadership and defined roles were critical to restoring functional smoothness and bridging what he called the current ‘trust deficit.’

For the Tata Group, the episode underscores both a consolidation of leadership and the enduring fragility of succession politics within India’s most influential corporate institution.